The New Apple TV is not out yet, but Big Cable providers are already running scared

The numbers are in, and they don’t look good for Comcast, DirectTV, Time Warner Cable, and company. According to the latest report from DigitalSmiths (a TiVo company), consumer behavior has evolved dramatically, year over year, until 2015, when consumers are finally spiraling away from multi-channel subscription offerings, towards a universe of on-demand a-la-carte subscription services available across multiple devices.

This includes tablets, smartphones, laptops, smart TVs, and ultimately Apple TV, which is about to open up a world of entertainment previously unseen on similarly prices set top boxes.

As previously mentioned, the recent refresh of Apple TV is not going to make things any better for Pay TV providers, especially according to how consumers feel about the value of their TV subscription services.

Pay TV at a glance

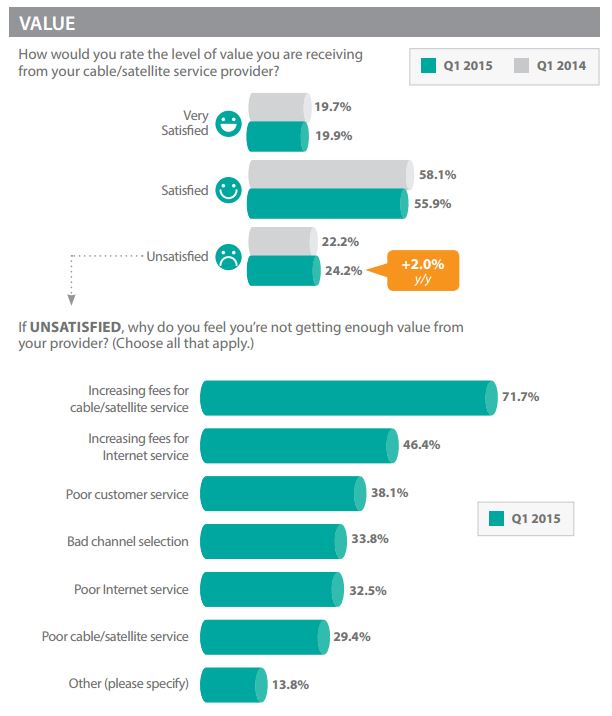

In the first quarter of 2015, respondents were asked how they would rate the level of value they receive from their cable/satellite providers. 19.9% described themselves as “very satisfied”, 55.9% said to be “satisfied”, and 24.2%, a full 2% increase compared to 2014, said to be unsatisfied with their service.

When breaking down the numbers of unsatisfied respondents, 71.7% said to be unhappy with increasing fees for TV service, followed by 46% of consumers dissatisfied about fees for Internet service. Poor customer service came third in the list, with 38.1% of dissatisfied respondents.

33.8% of people also complained about poor channel selection, 32.5% about poor Internet speed, 29% complained about bad reception or technical issues, and as much as 13.8% did not feel happy with a miscellaneous array of unspecified issues.

Warning signs

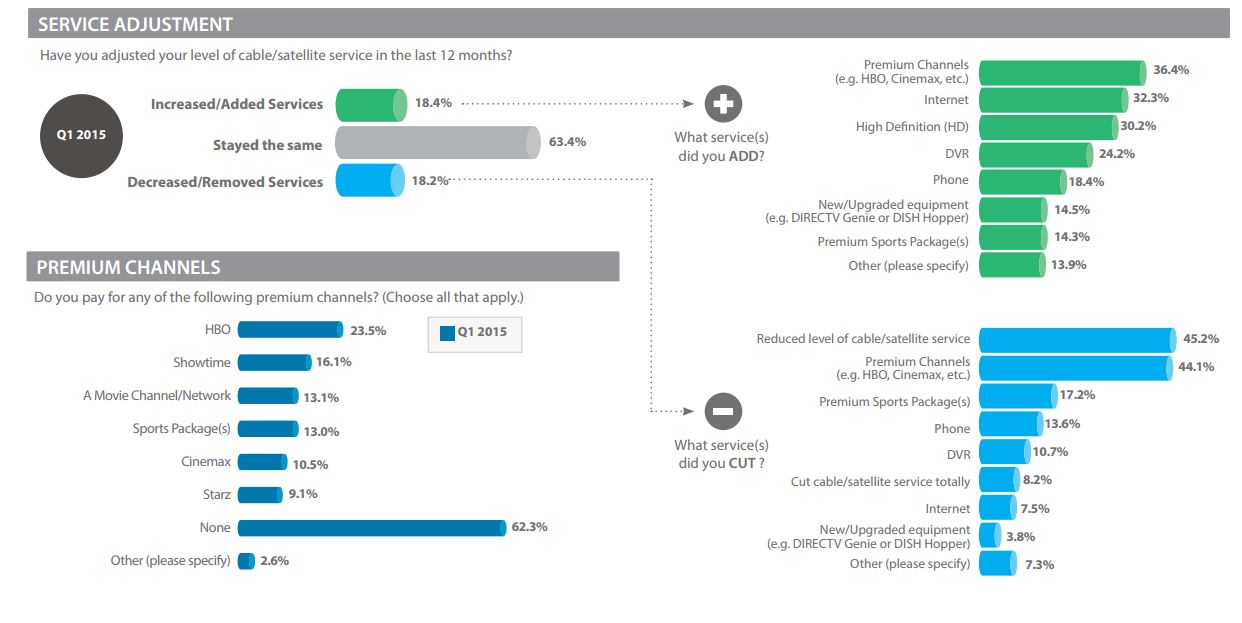

The first sign of a cord-cutter in the making comes usually in the form of service adjustments, which in the first quarter of 2015 reached a near-equal rate of increases/decreases, at 18.4%-18.2%, while 63% of subscribers made no adjustments, upgrades or downgrades to their service.

By that token, the numbers get more interesting as we delve deeper into the charts showing just what service have been upgraded and downgraded overtime.

While 36% of respondents said to have upgraded to premium channels, such as HBO, Cinemax, etc, as many as 45.2% have actually downgraded from the same services.

The trend truly comes to light when looking at the 32.3% of respondents who have upgraded their Internet speed (in essence those who value Internet connection over TV service), compared to the 7.5% who have downgraded their Internet speed.

HD and DVR have also soared, among the upgrades, which is to be expected as consumers are gravitating to services that allow them to watch content on their schedule, and not vice versa.

Premium sports packages have also taken a considerable hit, with 17.2% of respondents unsubscribing in the first quarter of 2015, compared to 14.3% of new subscriptions.

Even more bad news come from the 8.2% of respondents who simply had enough of their cable/satellite TV service entirely, and just eliminated the bill, keeping only their Internet service.

This is where Apple TV comes in

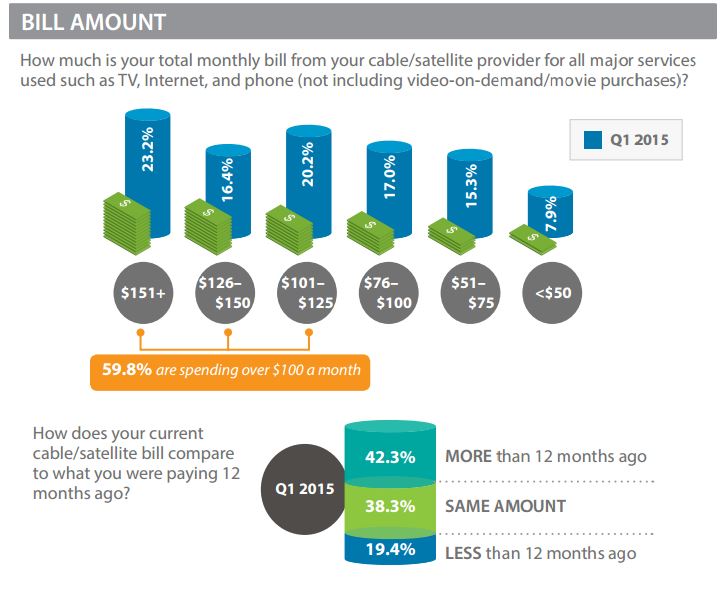

As many as 23% of surveyed consumers have reported their cable/satellite bill to be higher than $151 per month, 20.2% between $101 and $125, all the way down to 7.9% who said to pay less than $50 on their monthly cable bill. All in all, almost 60% of consumers are paying over $100 per month for their cable/satellite service, which translates in between $1200 and $1500, per household, per year. Let that sink in for a minute.

The typical channel line up of most cable/satellite subscription packages includes a range close to a hundred channels, but what are people actually watching?

Not surprisingly, while most consumers pay for what should be a staggering number of channels, only a limited number of channels actually does get exclusive attention.

Content providers are catching up to this trend big time, and nearly all of the above channels have an app that can be used to access the same content on Apple TV, iPhone, iPad, Macs and PCs, as long as a reliable Internet connection is available, which explains the percentage of respondents who are paying less than $50 of their monthly bill, AKA, the “trend setters”. Let’s have a quick look at just how many of these services can be accessed over the Internet:

- WATCH ABC

- Discovery Channel

- WATCH CBS

- NBC App

- History Channel App

- FOX NOW

- PBS (Streaming from website)

- HBO NOW/GO

- Comedy Central

- AMC

- Food Network

- Animal Planet

- The Weather Channel (Live from website)

- TBS (Live from website)

- HGTV Live

- TNT (Live from website)

- TLC

- FX NOW

- ESPN

What’s immediately apparent is that the most popular content providers are already available, on demand, without the need to sign up for Pay TV subscriptions.

The caveat in this case is that most of these services are not free. Some of them, like HBO for example, can cost as much as $15 per month, and being able to watch every single channel, would eventually be very expensive, however, the fact that none of these services require a contract, means that consumers are able to subscribe and unsubscribe more freely and dynamically, depending on the availability of their favorite content, whereas cable subscriptions are designed to tie subscribers into multi-year contracts that come with expensive disconnection fees, as well as the pain of going through “customer retention departments”, trained in persuading consumers to stay.

Here’s the best news

In the wake of Apple TV’s unveiling, news of Apple looking to start its own subscription service have made the rounds. The new service could start as early as next year, at a price point starting at $40, which should include most of the above list of channels. Apple TV’s search capability and updated interface will make it very easy to look for content, and watch it instantly, at a price range that is far more affordable that any comparable cable/satellite subscription.

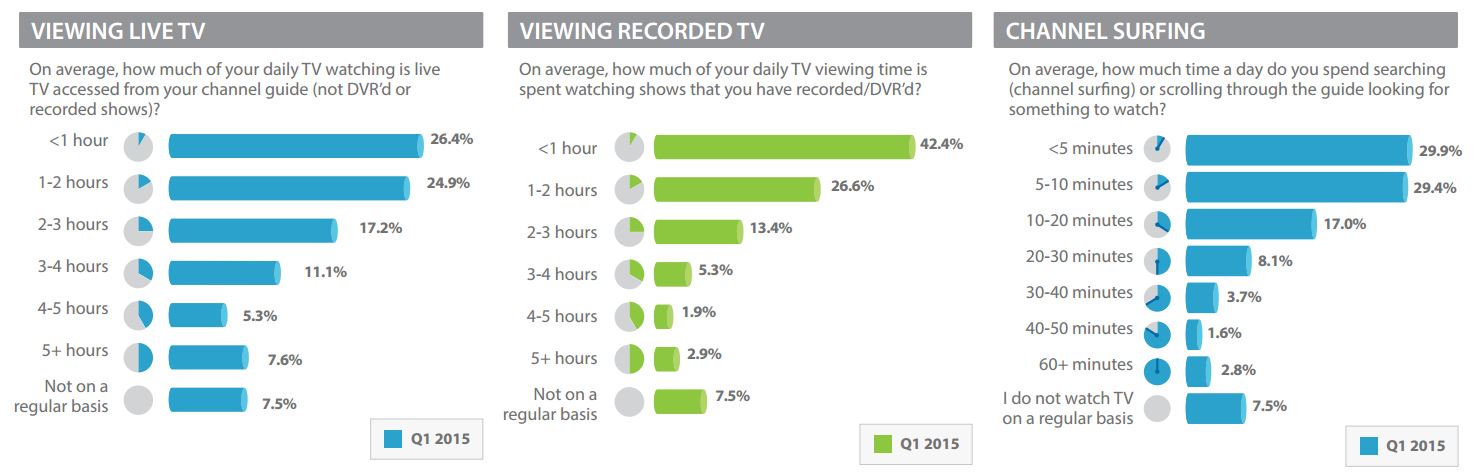

According to DigitalSmiths, at many as 69.0% of respondents said to watch 2 hours or less of recorded TV per day, and 51.3% watch less than 2 hours of live TV per day, with 46% of respondents surfing channels between 5 and 20 minutes a day.

Why is this important? Because when surfing channels using a regular remote, 20 minutes are simply not enough to discover content with some value to consumers, especially when most viewers get frustrated easily by exceedingly long commercial breaks. Offering a way to quickly search for content, is vital for subscribers retention.